can you pay california state taxes in installments

See if you Qualify for IRS Fresh Start Request Online. For example the State of California Franchise Tax Board.

Can I Pay Taxes In Installments

For many people the process of applying for an installment plan with the IRS may not be difficult.

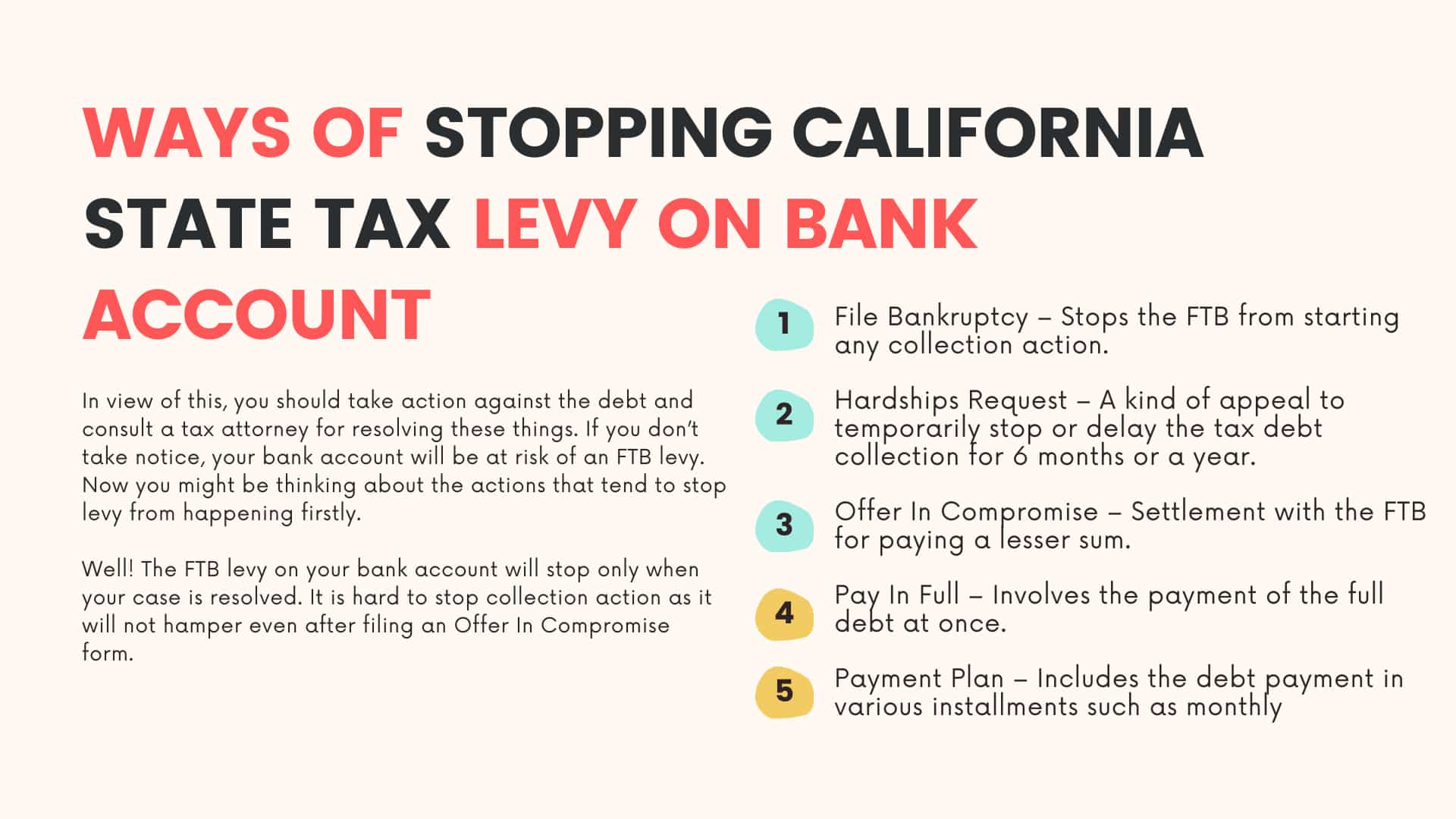

. In your question you said you are unable to pay the tax that is owed even assuming you compute the gain and tax correctly. Like the IRS and many states the California Franchise Tax Board offers taxpayers the ability to pay taxes due over time. EFT Unit PO Box 942857 Sacramento CA 94257-0501.

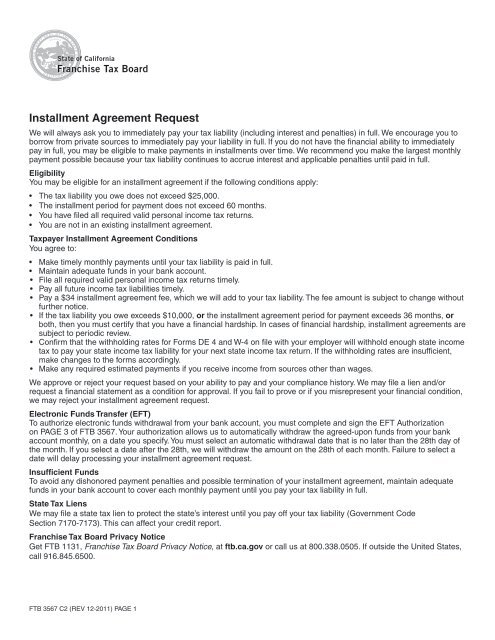

Affordable Reliable Services. Complete the form and mail it to. I have installments set up for my federal taxes but I did not see an option for California state taxes.

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Yes it is possible to pay taxes in installments.

If one of these events has happened and you are simply unable to pay immediately you may be wondering Can I pay taxes in installments Yes it is possible to pay taxes in instalments. Take Advantage of Fresh Start Options. For example if you reported an outstanding tax bill on your 2019 tax return on July 15 2020 in most cases the IRS has until July 15 2030 to collect the tax from you.

Ad Owe back tax 10K-200K. Visit a Western Union location near you to make your. Ad Tax Relief up to 95.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. An application fee of 34 will be added. See if you Qualify for IRS Fresh Start Request Online.

Ad Owe back tax 10K-200K. Box 2952 Sacramento CA 95812-2952. 31 Jan California State Tax Installment Agreement Request.

Franchise Tax Board Attn. Download Or Email FTB 3567 C2 More Fillable Forms Register and Subscribe Now. The taxes generally will be due April 15 of the following year eg.

If you owe taxes to the State of California but cant pay the full amount on time you may be able to set up a. If approved it costs you 50 to set-up an installment agreement added to your balanceIf you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an. Free Consult 30 Second Quote.

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Beautiful Rose Of Sharon Quilt Custom Made Hand Appliqued Quilt Amish Style Bedspread Colorful Roses Blanket Country Home Quilt King

Irs Installment Agreement Setting Up A Tax Payment Plan Debt Com

Irs Letter 4458c Second Installment Agreement Skip H R Block

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

How Do I Use The Shop Pay Installments Feature To Pay For My Order Brooklyn Tweed

3 Proven Ways To Stop California State Tax Levy On Bank Account

Can I Have Two Installment Agreements With The Irs

When Does It Make Sense To Elect Out Of The Installment Method

Property Tax Prorations Case Escrow

Installment Agreement Request California Franchise Tax Board

Secured Property Taxes Treasurer Tax Collector

Irs Form 9465 Guide To Installment Agreement Request

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)